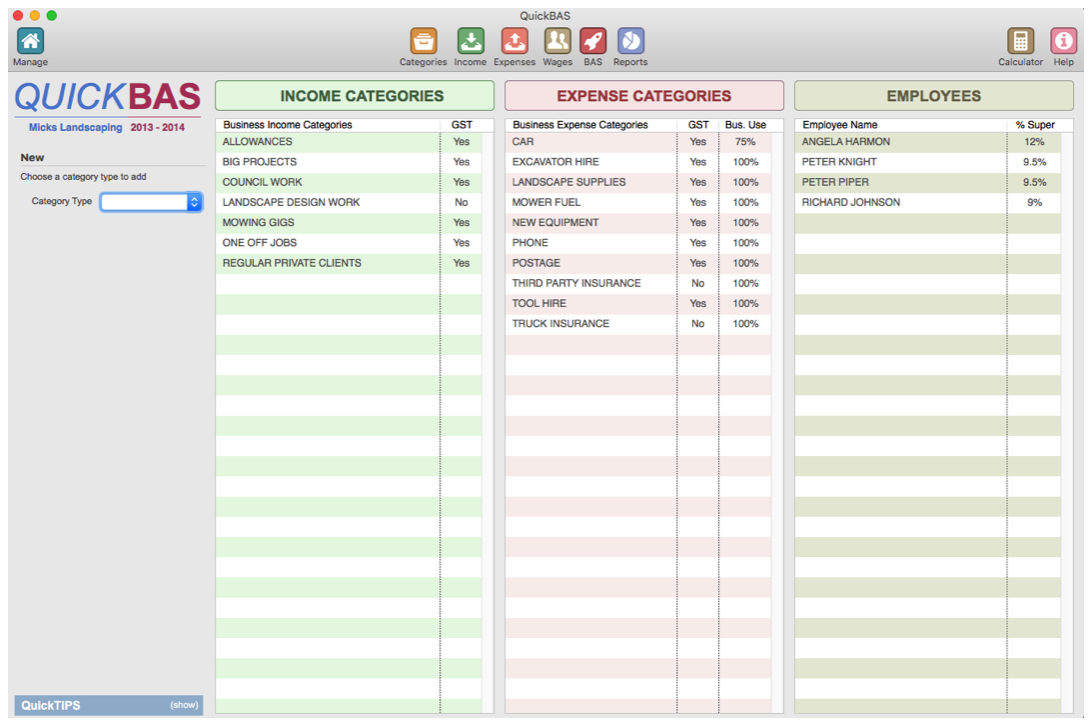

Categories - Manage Expense Categories

About Expense Categories

- All transactions in QuickBAS must belong to a Category

- Expense transactions go into Expense Categories

- The Category sheet shows Expense Categories in the middle list

- You can create whatever Categories you like, as best fits your business

- We recommend a maximum of about 20 Categories to keep things manageable

- Examples of Expense Categories might be Rent, Phone, Insurance and Car

- We recommend a Category called “Other” for miscellaneous expenses

- All transactions in QuickBAS must belong to a Category

- Expense transactions go into Expense Categories

- The Category sheet shows Expense Categories in the middle list

- You can create whatever Categories you like, as best fits your business

- We recommend a maximum of about 20 Categories to keep things manageable

- Examples of Expense Categories might be Rent, Phone, Insurance and Car

- We recommend a Category called “Other” for miscellaneous expenses

- click to enlarge -

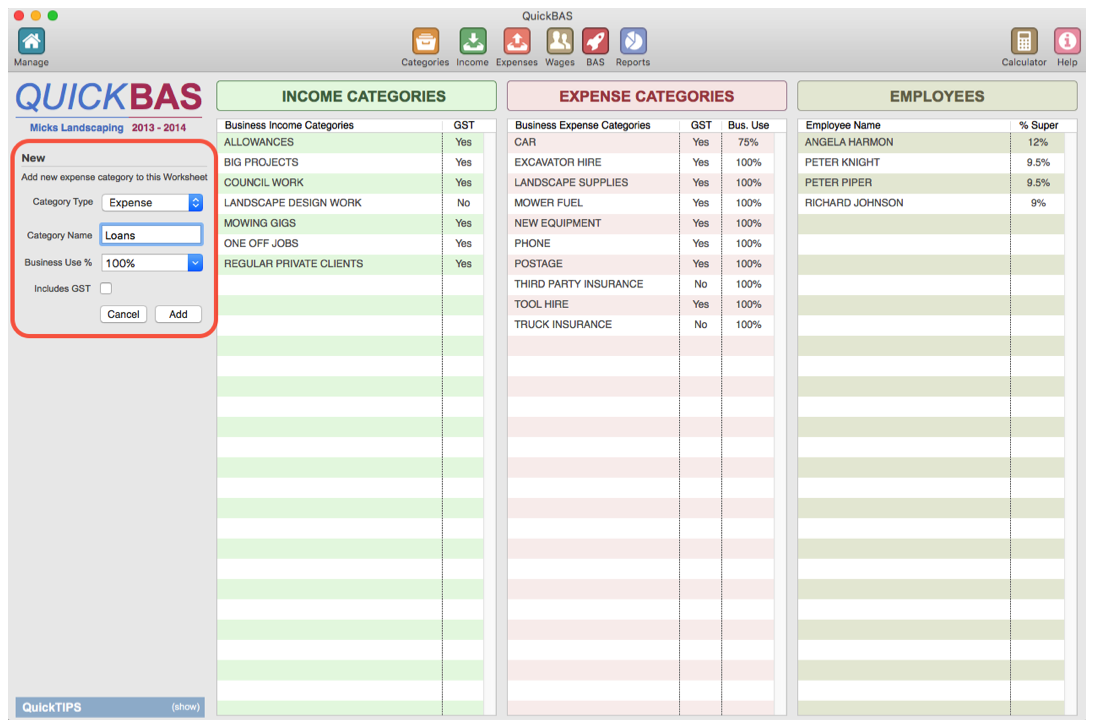

Add an Expense Category

- You must already have created and opened a BAS Worksheet

- Access the Categories page by clicking on the Categories icon

- Click on “Expense” in the Category Type drop-down menu

- Or just click on an empty part of the Expense Category list

- Fill out the Expense Category details in the panel

- You can choose a default business use percentage

- e.g. if you use a phone for 67% business and 33% personal, choose 67%

- You can choose one of the given Business Use % values, or type your own

- Click the “Includes GST” box if this Category usually contains GST

- You can edit Business Use and GST when you enter individual transactions

- Click “Add” and your new Expense Category appears in the list

- You must already have created and opened a BAS Worksheet

- Access the Categories page by clicking on the Categories icon

- Click on “Expense” in the Category Type drop-down menu

- Or just click on an empty part of the Expense Category list

- Fill out the Expense Category details in the panel

- You can choose a default business use percentage

- e.g. if you use a phone for 67% business and 33% personal, choose 67%

- You can choose one of the given Business Use % values, or type your own

- Click the “Includes GST” box if this Category usually contains GST

- You can edit Business Use and GST when you enter individual transactions

- Click “Add” and your new Expense Category appears in the list

- click to enlarge -

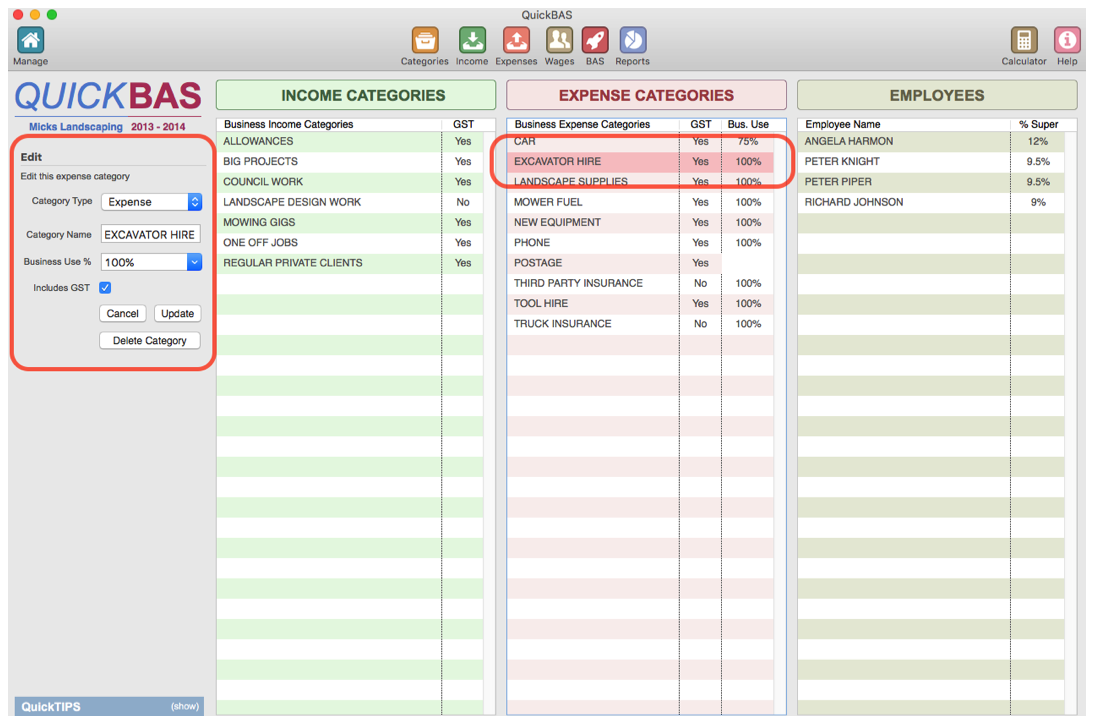

Edit or Delete an Expense Category

- Click on the Expense Category to edit from the list

- You can change the Expense Category name or the default Business Use %

- Click “Update” to finish the edit

- If you changed the name, then all transactions using that category will also change

- If you changed the Business Use %, this only affects future entries, not those already entered

- You can delete an Expense Category by choosing it and clicking “Delete Category”

- You cannot delete an Expense Category that already has transactions

- Click on the Expense Category to edit from the list

- You can change the Expense Category name or the default Business Use %

- Click “Update” to finish the edit

- If you changed the name, then all transactions using that category will also change

- If you changed the Business Use %, this only affects future entries, not those already entered

- You can delete an Expense Category by choosing it and clicking “Delete Category”

- You cannot delete an Expense Category that already has transactions

- click to enlarge -

QuickBAS User Guide - Expense Categories