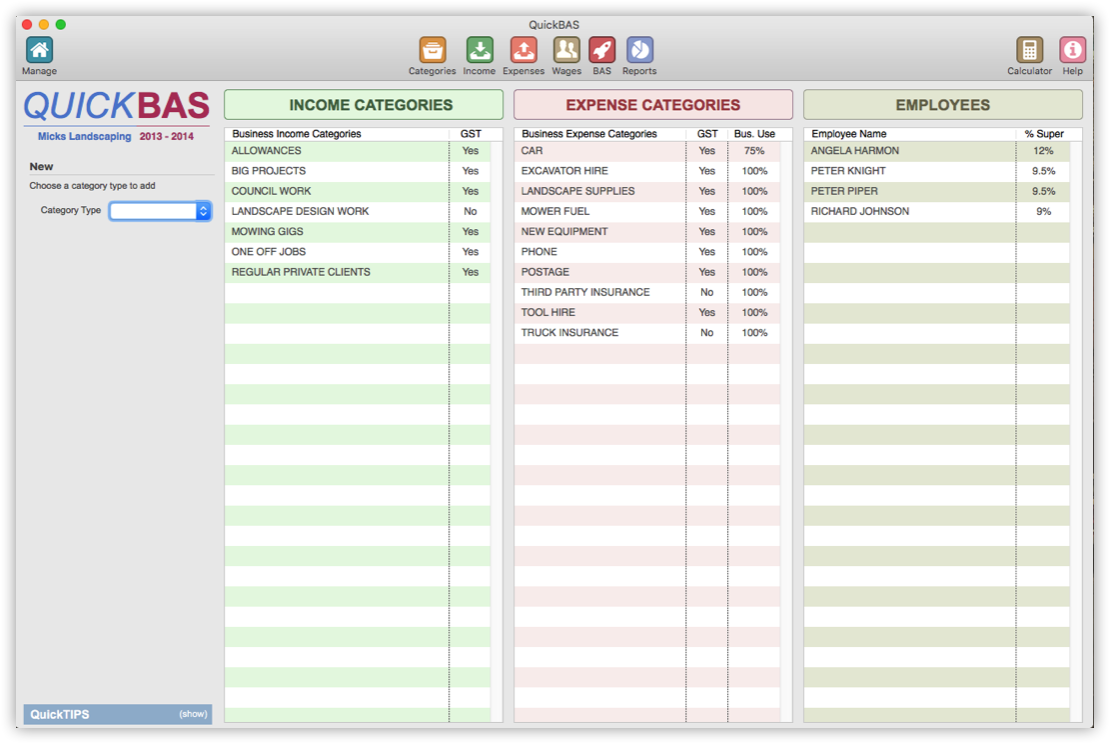

Categories - Manage Income Categories

About Income Categories

- All transactions in QuickBAS must belong to a Category

- Income transactions go into Income Categories

- The Category sheet shows Income Categories on the left

- You can create whatever Categories you like, as best fits your business

- We recommend a maximum of about 20 Categories to keep things manageable

- Examples of Income Categories might be Sales, Rent Received, Interest Received

- We recommend a Category called “Other” for miscellaneous income

- All transactions in QuickBAS must belong to a Category

- Income transactions go into Income Categories

- The Category sheet shows Income Categories on the left

- You can create whatever Categories you like, as best fits your business

- We recommend a maximum of about 20 Categories to keep things manageable

- Examples of Income Categories might be Sales, Rent Received, Interest Received

- We recommend a Category called “Other” for miscellaneous income

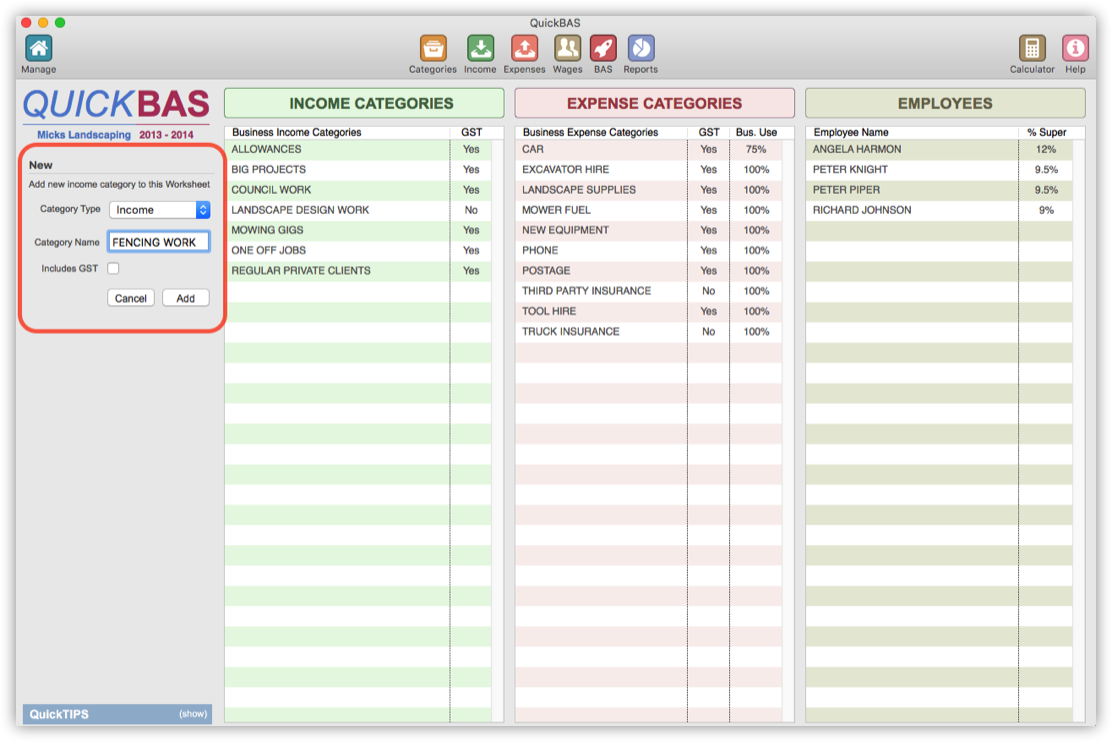

Add an Income Category

- You must already have created and opened a BAS Worksheet

- Access the Categories page by clicking on the Categories icon

- Click on “Income” in the Category Type drop-down menu

- Fill out the Income Category details in the panel

- Click the “Includes GST” box if this Category usually contains GST

- You can edit GST amounts when you enter individual income transactions

- Click “Add” and your new Income Category appears in the list

- You must already have created and opened a BAS Worksheet

- Access the Categories page by clicking on the Categories icon

- Click on “Income” in the Category Type drop-down menu

- Fill out the Income Category details in the panel

- Click the “Includes GST” box if this Category usually contains GST

- You can edit GST amounts when you enter individual income transactions

- Click “Add” and your new Income Category appears in the list

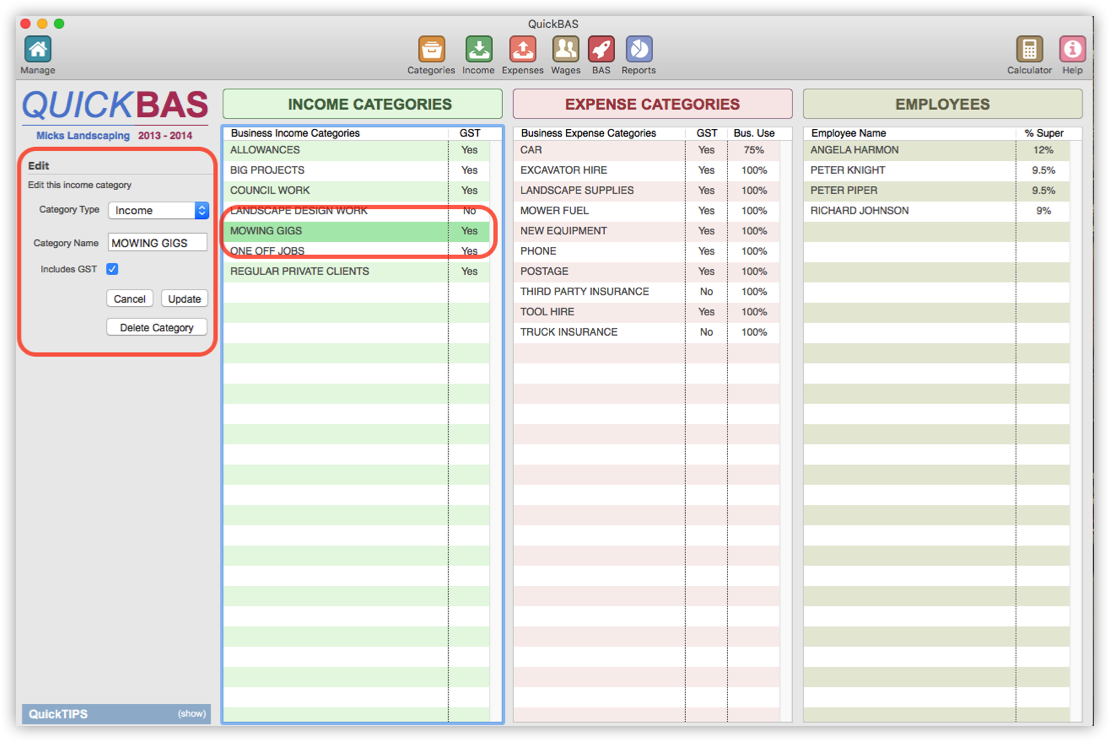

Edit or Delete an Income Category

- Click on the Income Category to edit from the list of Income Categories

- You can change the Income Category name or the default GST status

- Click “Update” to finish the edit

- If you changed the name, then all transactions using that category will also change

- If you changed the GST status, this only affects future entries, not those already entered

- You can delete an Income Category by choosing it and clicking “Delete Category”

- You cannot delete an Income Category that already has transactions

- Click on the Income Category to edit from the list of Income Categories

- You can change the Income Category name or the default GST status

- Click “Update” to finish the edit

- If you changed the name, then all transactions using that category will also change

- If you changed the GST status, this only affects future entries, not those already entered

- You can delete an Income Category by choosing it and clicking “Delete Category”

- You cannot delete an Income Category that already has transactions

QuickBAS User Guide - Income Categories