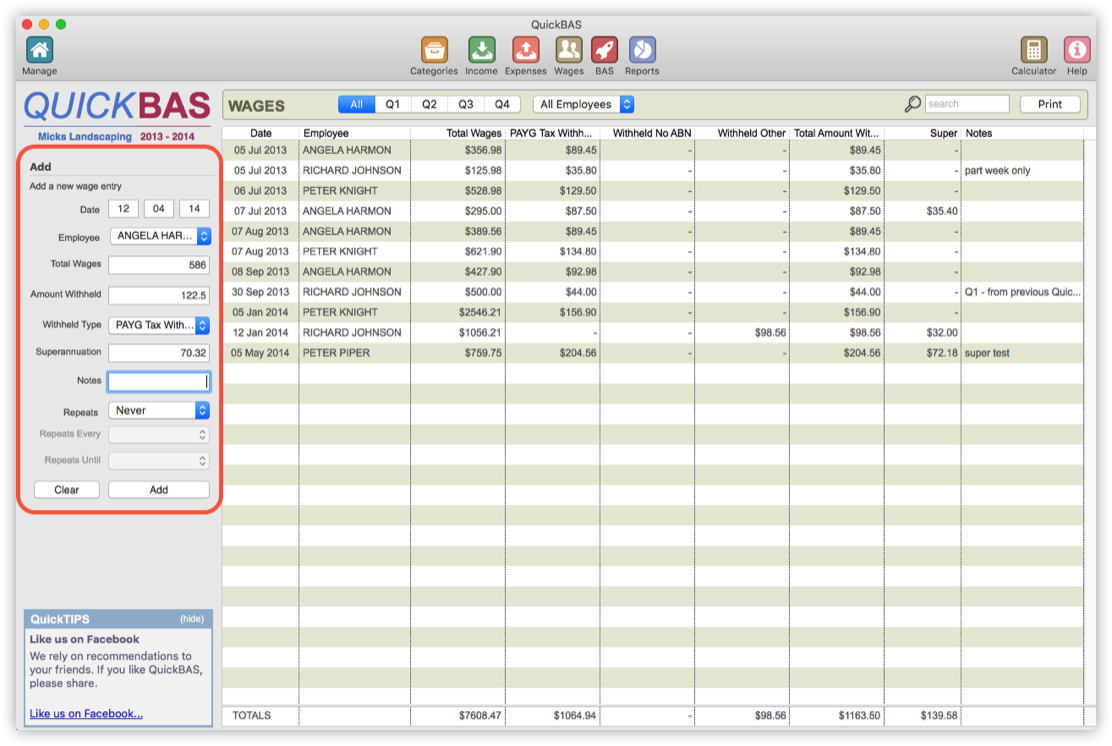

THE WAGES SHEET - Add a Wages Entry

Add a Wages and Tax Withheld Entry

- You must have created and opened a BAS Worksheet before entering wages

- Access the Wages Sheet using the Wages icon in the top menu

- Use the fields at the left to add a Wages entry

- Date uses DD MM YY format

- You must add employees (on the Categories sheet) before you add wages.

- Total Wages includes any tax, but excludes superannuation

- Amount Withheld is the amount you withheld as PAYG tax from an employees wage

- Withheld Type for employees is usually “PAYG Tax Withheld”

- Please refer to the ATO site for other types of Withholding tax

- Click “Add” and the Wages entry is added to the list.

- You must have created and opened a BAS Worksheet before entering wages

- Access the Wages Sheet using the Wages icon in the top menu

- Use the fields at the left to add a Wages entry

- Date uses DD MM YY format

- You must add employees (on the Categories sheet) before you add wages.

- Total Wages includes any tax, but excludes superannuation

- Amount Withheld is the amount you withheld as PAYG tax from an employees wage

- Withheld Type for employees is usually “PAYG Tax Withheld”

- Please refer to the ATO site for other types of Withholding tax

- Click “Add” and the Wages entry is added to the list.

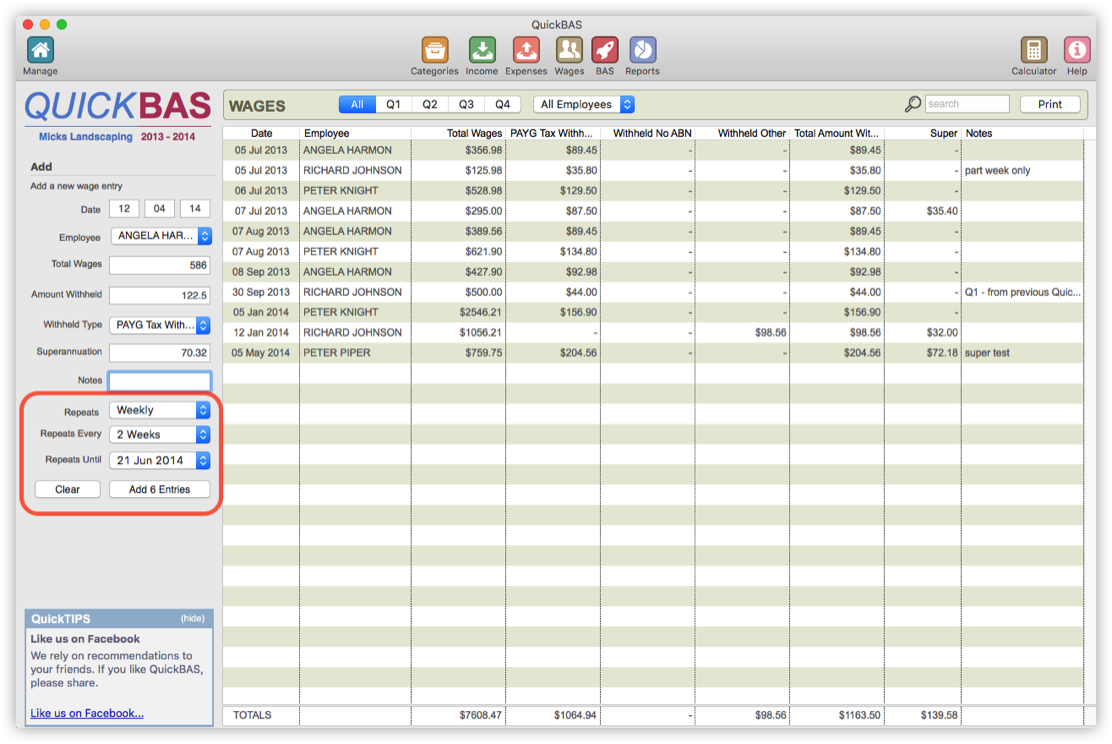

Add a Repeating Wages Entry

- Your Wages will usually repeat

- You can add multiple repeating Wages transactions in one step

- Start by filling out the Wages fields as normal

- The Date field will be the start date

- Use the “Repeats” dropdown to choose daily, weekly or monthly repeats

- Use the “Repeats Every” dropdown to choose the repeat period

- Use the “Repeats Until” dropdown to choose the end date

- Note the “Add Entry” button now shows the number of entries to be added

- Your Wages will usually repeat

- You can add multiple repeating Wages transactions in one step

- Start by filling out the Wages fields as normal

- The Date field will be the start date

- Use the “Repeats” dropdown to choose daily, weekly or monthly repeats

- Use the “Repeats Every” dropdown to choose the repeat period

- Use the “Repeats Until” dropdown to choose the end date

- Note the “Add Entry” button now shows the number of entries to be added

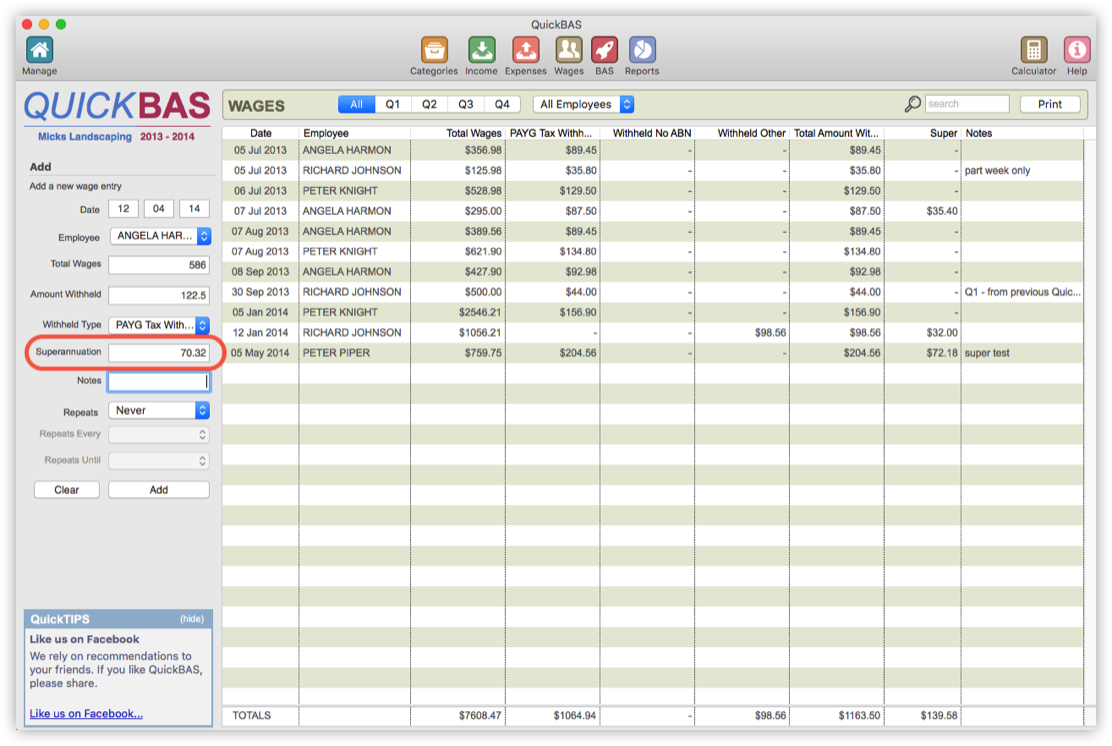

Superannuation

- Super is not reported on a Business Activity Statement

- However, QuickBAS allows you to add super amounts for your business records

- When you add an employee, you can choose to enter a default super %

- QuickBAS automatically calculates super amounts based on the percentage you set

- You can edit super amounts for any wage entry and any employee

- Super is not reported on a Business Activity Statement

- However, QuickBAS allows you to add super amounts for your business records

- When you add an employee, you can choose to enter a default super %

- QuickBAS automatically calculates super amounts based on the percentage you set

- You can edit super amounts for any wage entry and any employee

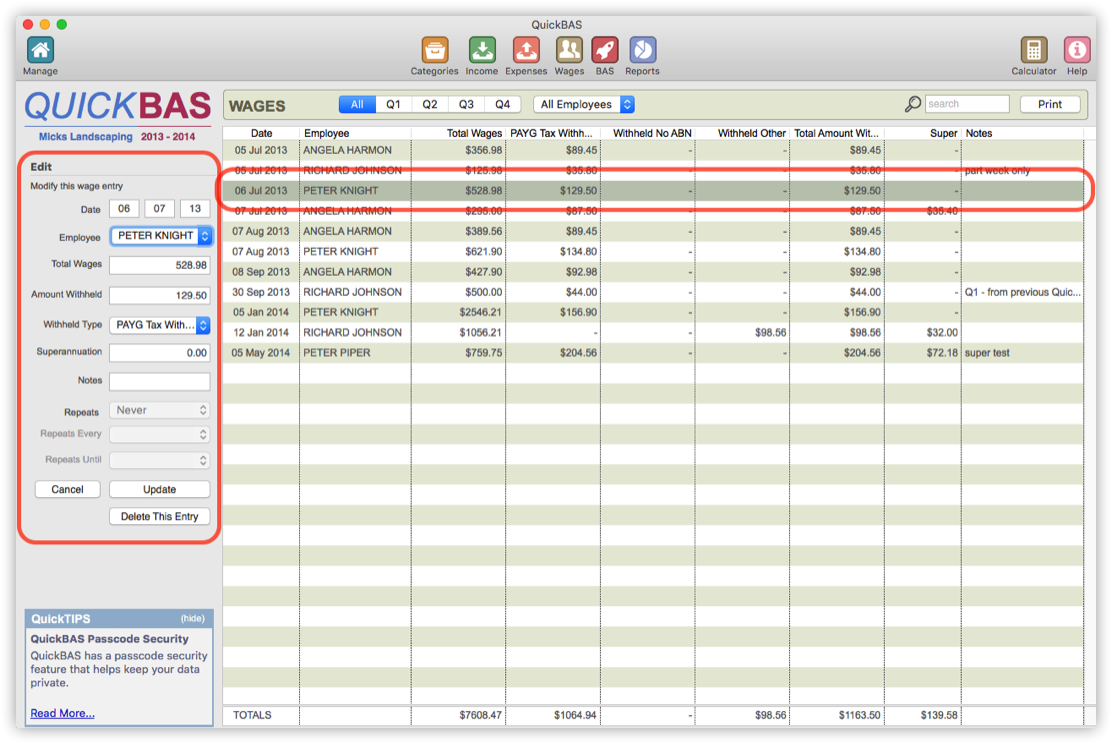

Edit a Wages and Tax Withheld Entry

- You can edit any Wages entry previously entered

- Click on the entry you wish to edit in the list

- The Wages entry gets highlighted and the details are filled in the fields

- You can edit the values in the fields

- The “Add” button changes to “Update”

- Click “Update” to save the edits

- You can delete a highlighted entry by clicking on “Delete This Entry”

- Batch editing is not available on the Wages Sheet

- You can edit any Wages entry previously entered

- Click on the entry you wish to edit in the list

- The Wages entry gets highlighted and the details are filled in the fields

- You can edit the values in the fields

- The “Add” button changes to “Update”

- Click “Update” to save the edits

- You can delete a highlighted entry by clicking on “Delete This Entry”

- Batch editing is not available on the Wages Sheet

QuickBAS User Guide - Add Wages