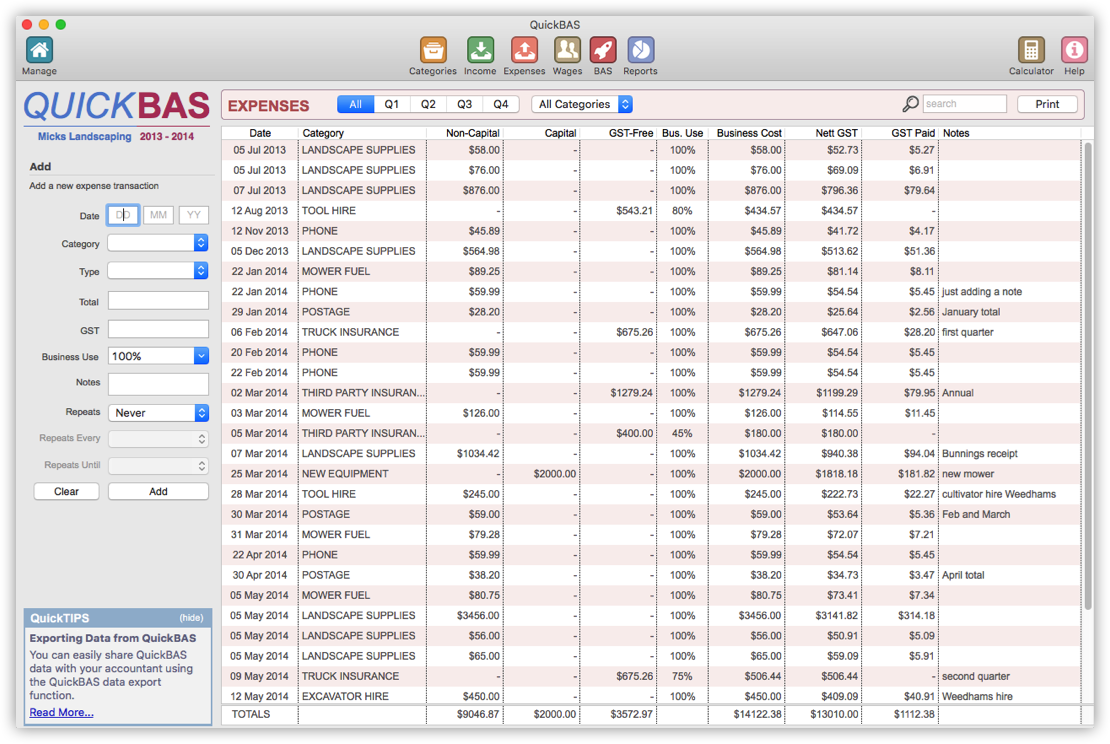

The Expenses Sheet - Add An Expense Transaction

About the Expenses Sheet

- The Expenses Sheet stores all your expense transactions

- QuickBAS lists all your expense transactions based on GST status

- Expense entries can be Non-Capital with GST, Capital Expense, or GST-Free Expense

- The values are tallied at the bottom of each column

- You can sort entries by clicking on the column header

- You can search for entries using the search field

- You can filter entries by quarter, by category or by search term

- The Expenses Sheet stores all your expense transactions

- QuickBAS lists all your expense transactions based on GST status

- Expense entries can be Non-Capital with GST, Capital Expense, or GST-Free Expense

- The values are tallied at the bottom of each column

- You can sort entries by clicking on the column header

- You can search for entries using the search field

- You can filter entries by quarter, by category or by search term

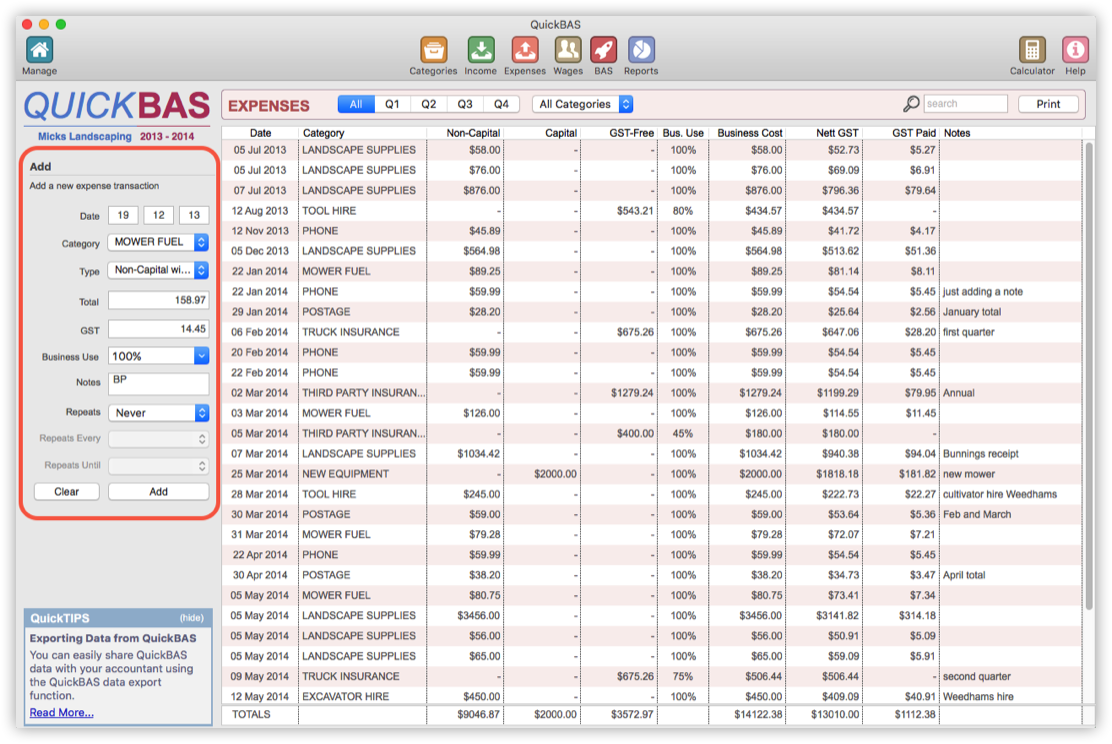

Add a Single Expense Transaction

- You must have created and opened a BAS Worksheet before entering income entries

- Access the Expense Sheet using the Expenses icon in the top menu

- Use the fields at left to enter a new expense entry

- Date is entered as DD MM YY

- The categories are those you entered in your Expense Category sheet

- The Type is usually “Non-Capital With GST”

- You may have expenses that are Capital or GST-Free

- The Total is the full expense amount, including GST (if any)

- QuickBAS will calculate GST amounts based on the GST rate and the Category type

- However, you can edit GST, eg if only a part of the total includes GST

- You can specify the percentage business use. Use a pre-set or enter any percentage.

- The Notes area lets you enter details such as invoice number or supplier

- Click “Add” to add the expense transaction to the list

- You must have created and opened a BAS Worksheet before entering income entries

- Access the Expense Sheet using the Expenses icon in the top menu

- Use the fields at left to enter a new expense entry

- Date is entered as DD MM YY

- The categories are those you entered in your Expense Category sheet

- The Type is usually “Non-Capital With GST”

- You may have expenses that are Capital or GST-Free

- The Total is the full expense amount, including GST (if any)

- QuickBAS will calculate GST amounts based on the GST rate and the Category type

- However, you can edit GST, eg if only a part of the total includes GST

- You can specify the percentage business use. Use a pre-set or enter any percentage.

- The Notes area lets you enter details such as invoice number or supplier

- Click “Add” to add the expense transaction to the list

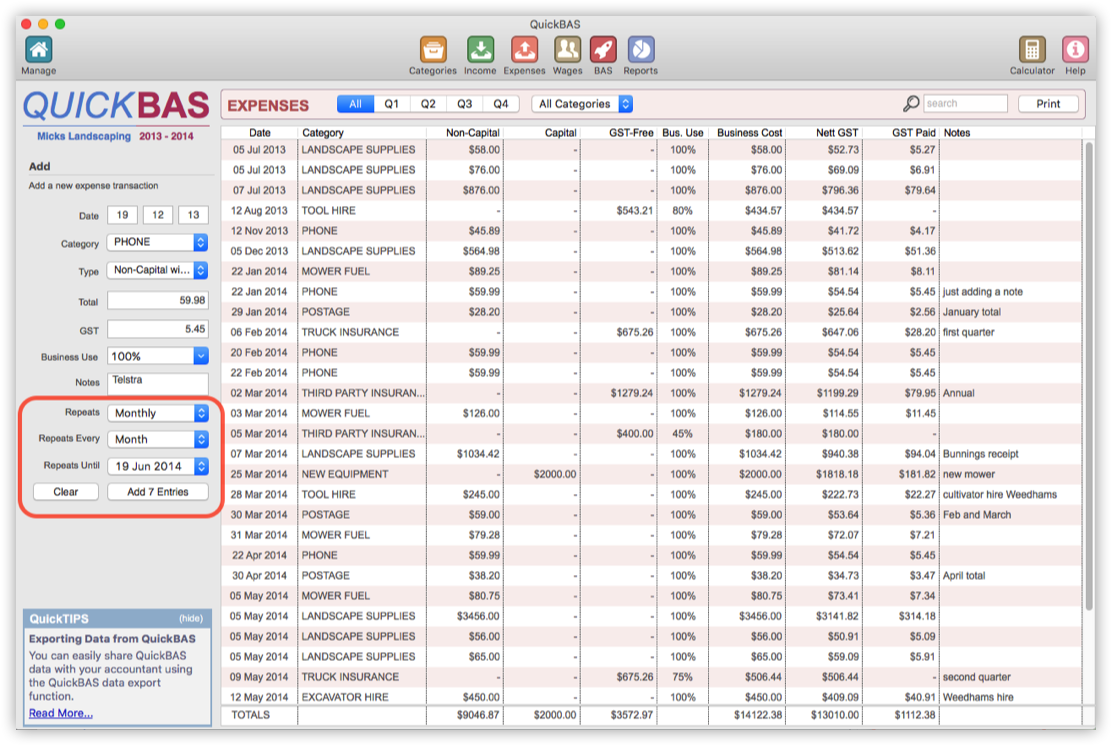

Add a Repeating Expense Transaction

- Your business may have regularly repeating expense transactions

- You can add multiple repeating transactions in one step

- Add an entry as above, using the Date field as the start date

- Use the “Repeats” dropdown to choose daily, weekly or monthly repeats

- Use the “Repeats Every” dropdown to choose the repeat period

- Use the “Repeats Until” dropdown to choose the end date

- Note the “Add Entry” button now shows the number of entries to be added

- Your business may have regularly repeating expense transactions

- You can add multiple repeating transactions in one step

- Add an entry as above, using the Date field as the start date

- Use the “Repeats” dropdown to choose daily, weekly or monthly repeats

- Use the “Repeats Every” dropdown to choose the repeat period

- Use the “Repeats Until” dropdown to choose the end date

- Note the “Add Entry” button now shows the number of entries to be added

QuickBAS User Guide - Add an Expense Entry