Reports - Income, Expenses and Wages

The Reports Sheet

- The Reports provide a summary of your business’ transactions

- You have the option for annual, quarterly or monthly reports

- These reports can be useful to analyse your business cash flow

- They can also be useful for your business’ annual tax return

- Access the Reports Sheet by clicking on the Reports icon in the top menu

- You must have a BAS Worksheet open to access Reports

- The Reports provide a summary of your business’ transactions

- You have the option for annual, quarterly or monthly reports

- These reports can be useful to analyse your business cash flow

- They can also be useful for your business’ annual tax return

- Access the Reports Sheet by clicking on the Reports icon in the top menu

- You must have a BAS Worksheet open to access Reports

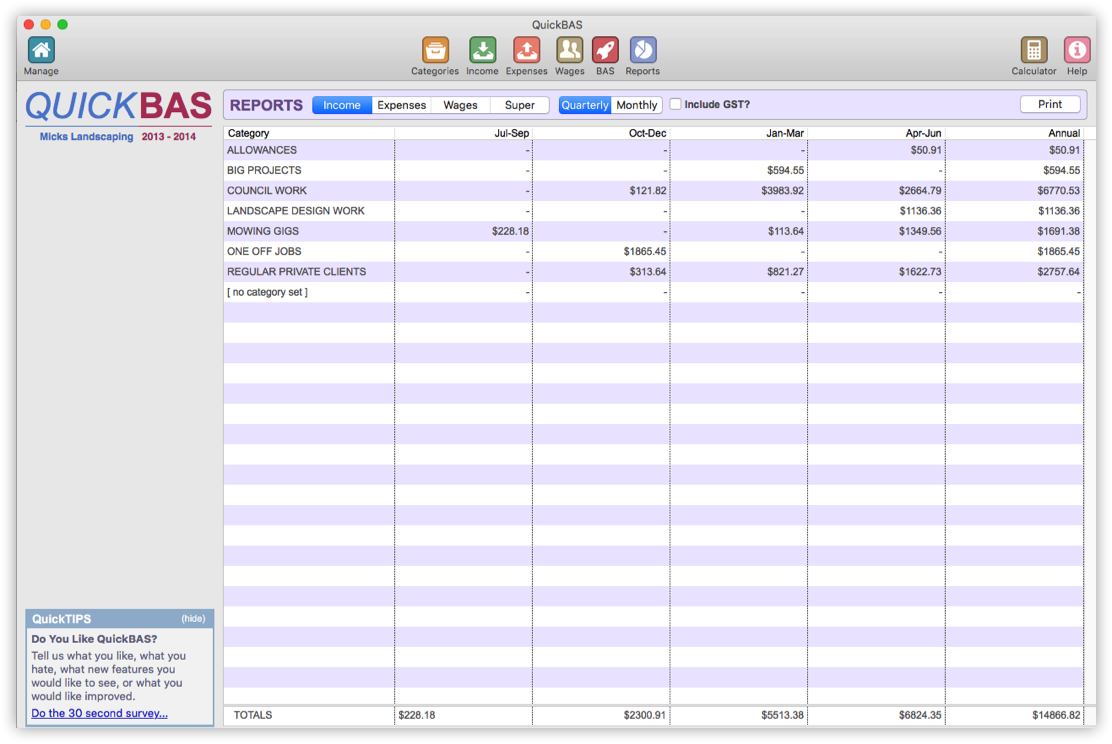

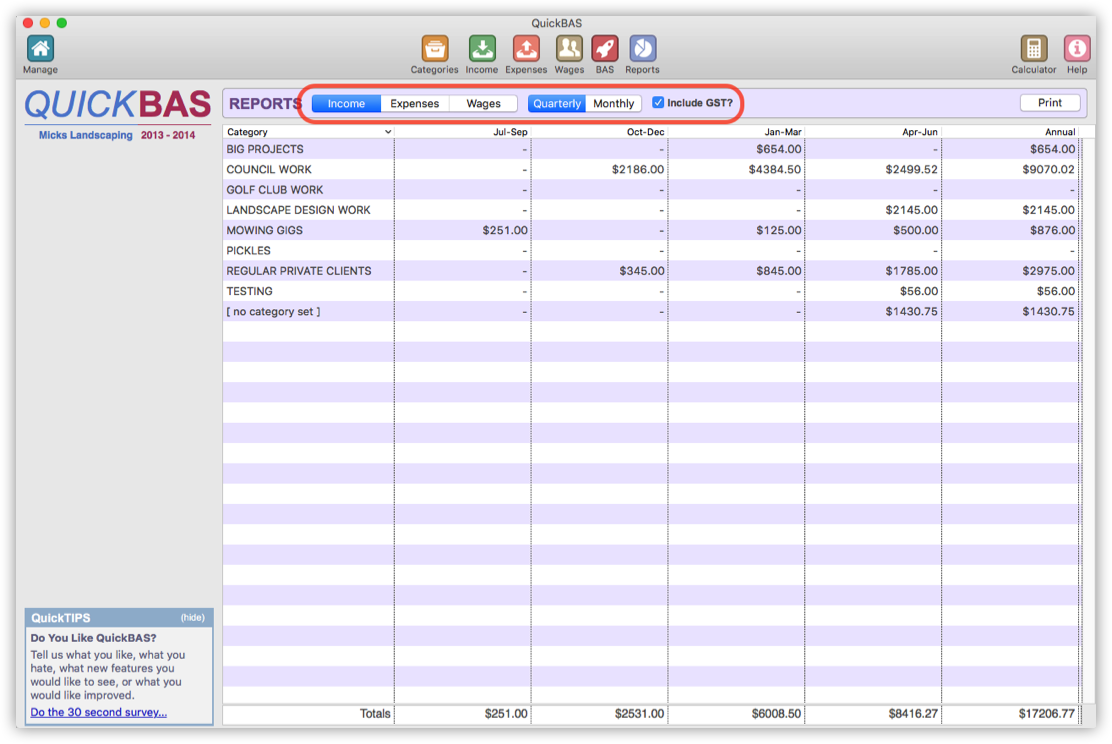

The Income Report

- The Income Report shows business income broken down by Income Category

- You can choose Annual, Quarterly or Monthly views

- You can also choose to view with or without GST included

- For annual tax returns, the GST-excluded option is appropriate as you have already reported GST in your BAS

- The Income Report shows business income broken down by Income Category

- You can choose Annual, Quarterly or Monthly views

- You can also choose to view with or without GST included

- For annual tax returns, the GST-excluded option is appropriate as you have already reported GST in your BAS

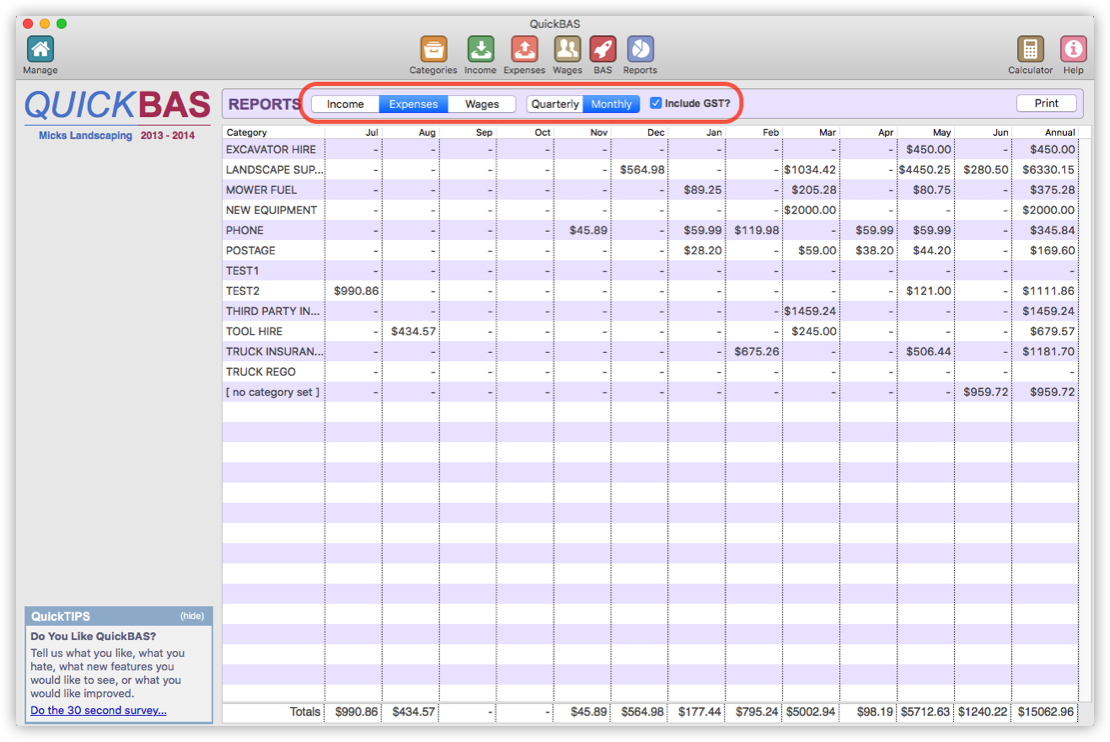

The Expenses Report

- The Expenses Report shows business expenses broken down by Expense Category

- You can choose Annual, Quarterly or Monthly views

- You can also choose to view with or without GST included

- For annual tax returns, the GST-excluded option is appropriate as you have already reported GST in your BAS

- The Expenses Report shows business expenses broken down by Expense Category

- You can choose Annual, Quarterly or Monthly views

- You can also choose to view with or without GST included

- For annual tax returns, the GST-excluded option is appropriate as you have already reported GST in your BAS

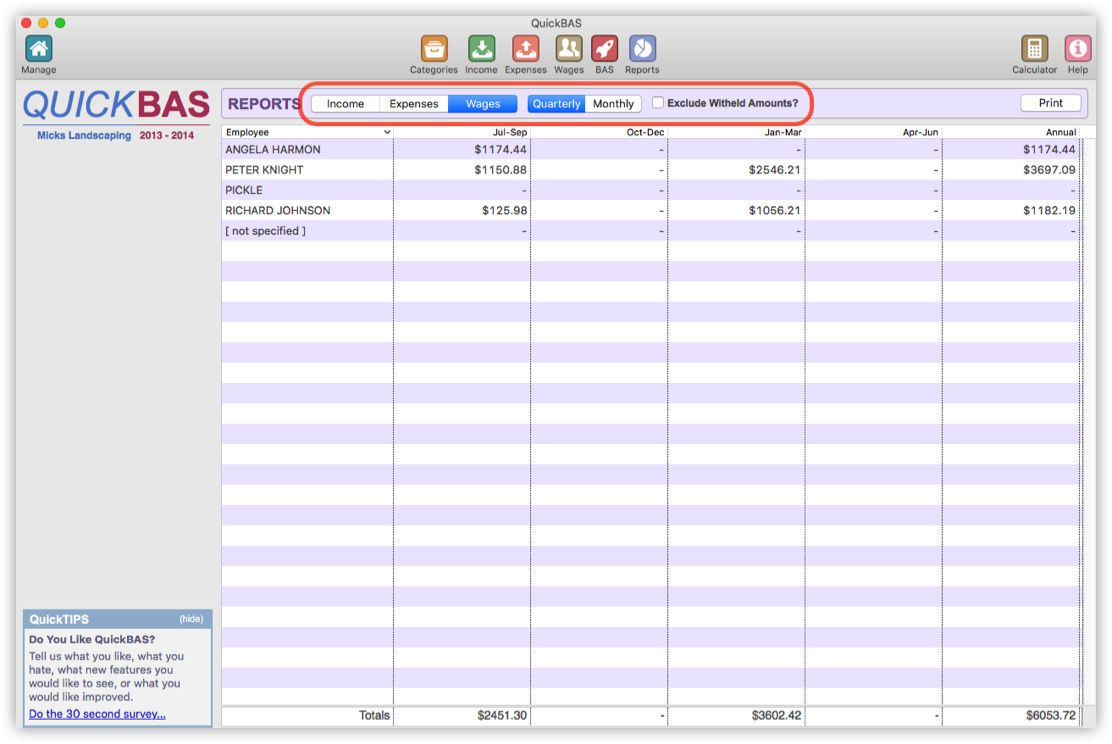

The Wages Report

- The Wages Report shows business wages broken down by Employee

- You can choose Annual, Quarterly or Monthly views

- You can also choose to view with or without Tax Withheld amounts

- The Wages Report shows business wages broken down by Employee

- You can choose Annual, Quarterly or Monthly views

- You can also choose to view with or without Tax Withheld amounts

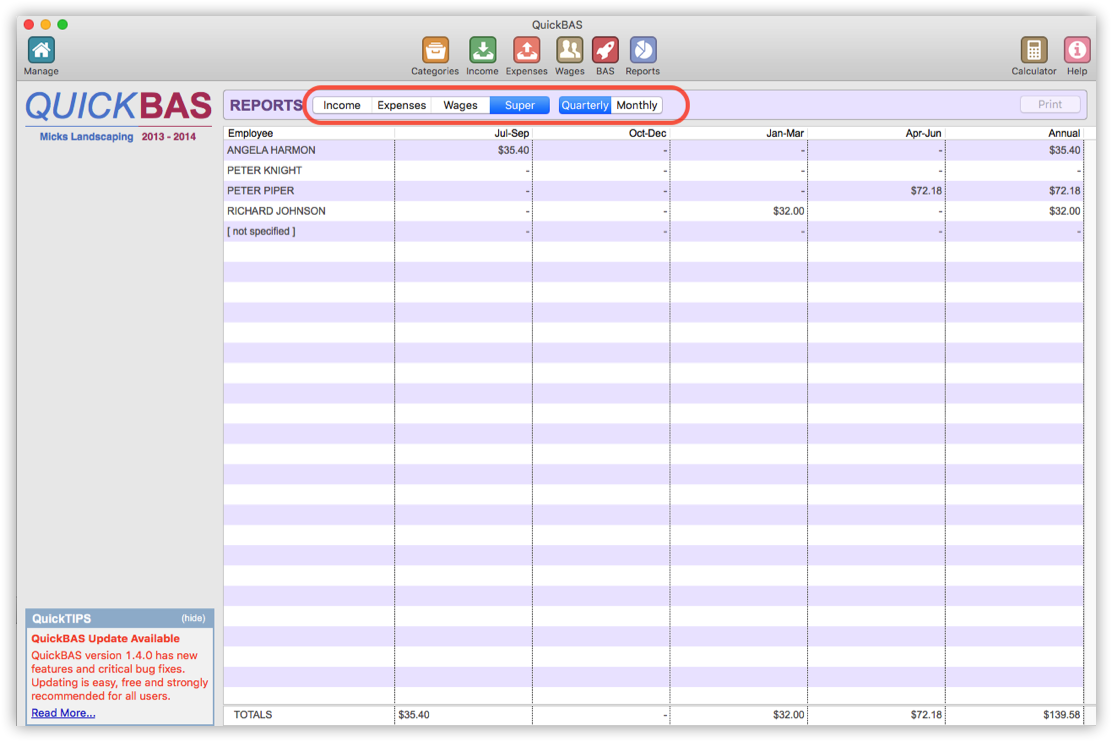

The Superannuation Report

- The Super Report shows superannuation broken down by Employee

- You can choose Annual, Quarterly or Monthly views

- Note that super is not a reportable item for you BAS

- This report may help you with tax annual tax returns

- The Super Report shows superannuation broken down by Employee

- You can choose Annual, Quarterly or Monthly views

- Note that super is not a reportable item for you BAS

- This report may help you with tax annual tax returns

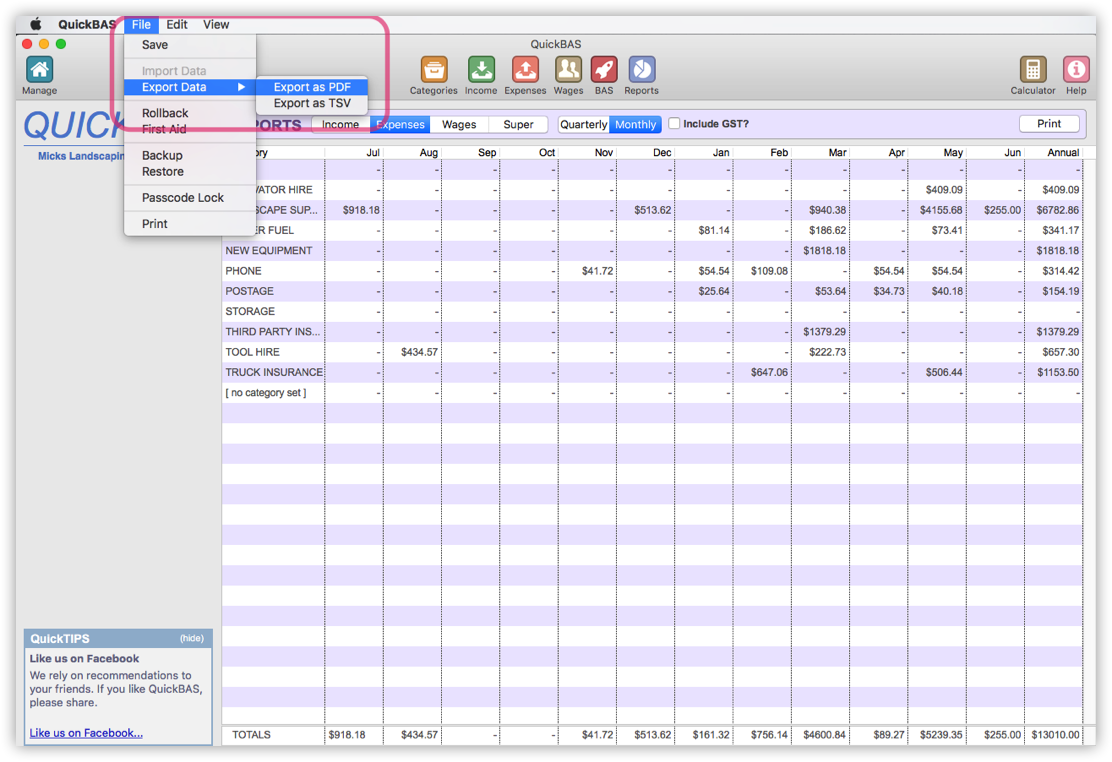

Exporting Reports data

- You can export data from any report in PDF or TSV formats

- This lets you save or share data with 3rd parties, such as your accountant

- Access the Export function from the File menu

- Choose PDF or Tab-Separated Values (TSV) formats

- TSV can be opened by all spreadsheet programs

- You can export data from any report in PDF or TSV formats

- This lets you save or share data with 3rd parties, such as your accountant

- Access the Export function from the File menu

- Choose PDF or Tab-Separated Values (TSV) formats

- TSV can be opened by all spreadsheet programs

QuickBAS User Guide - BAS Reports