The BAS Sheet - Setting BAS Options

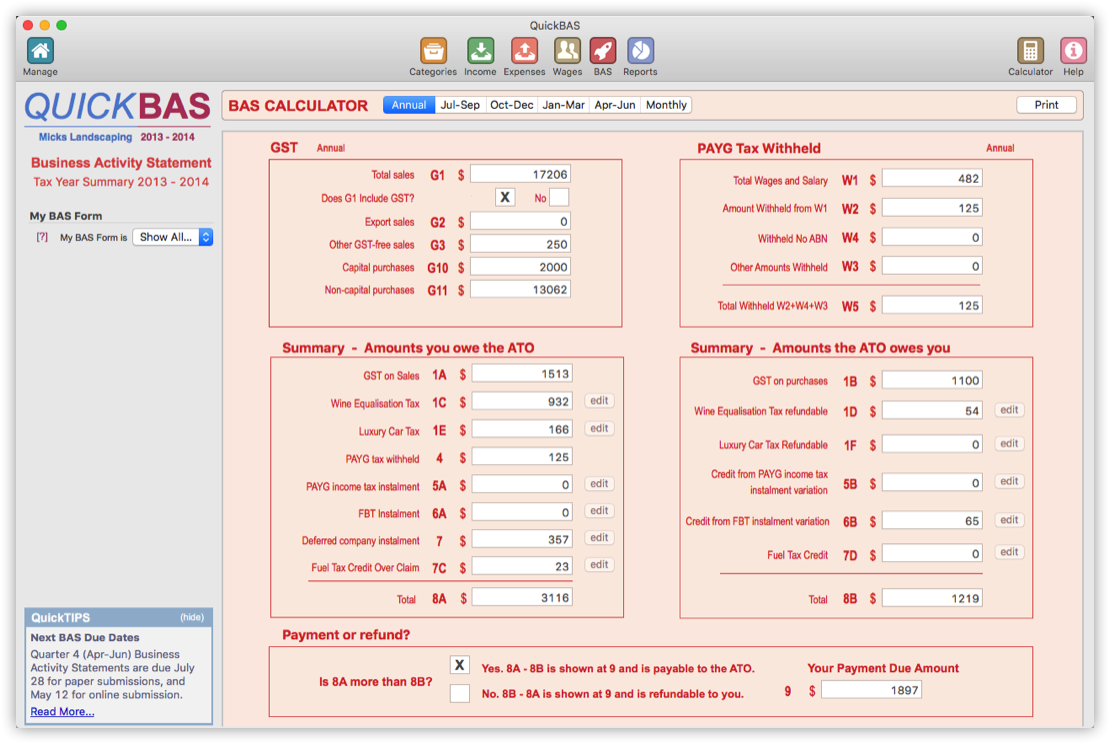

THE BAS SHEET

- The BAS Sheet calculates all your Business Activity Statement values

- Access the BAS Sheet by clicking on the BAS icon in the top menu

- You must have a Worksheet opened (on the Worksheet Manager) to access the BAS Sheet

- By default, The BAS Sheet shows an Annual Summary

- The BAS Sheet calculates all your Business Activity Statement values

- Access the BAS Sheet by clicking on the BAS icon in the top menu

- You must have a Worksheet opened (on the Worksheet Manager) to access the BAS Sheet

- By default, The BAS Sheet shows an Annual Summary

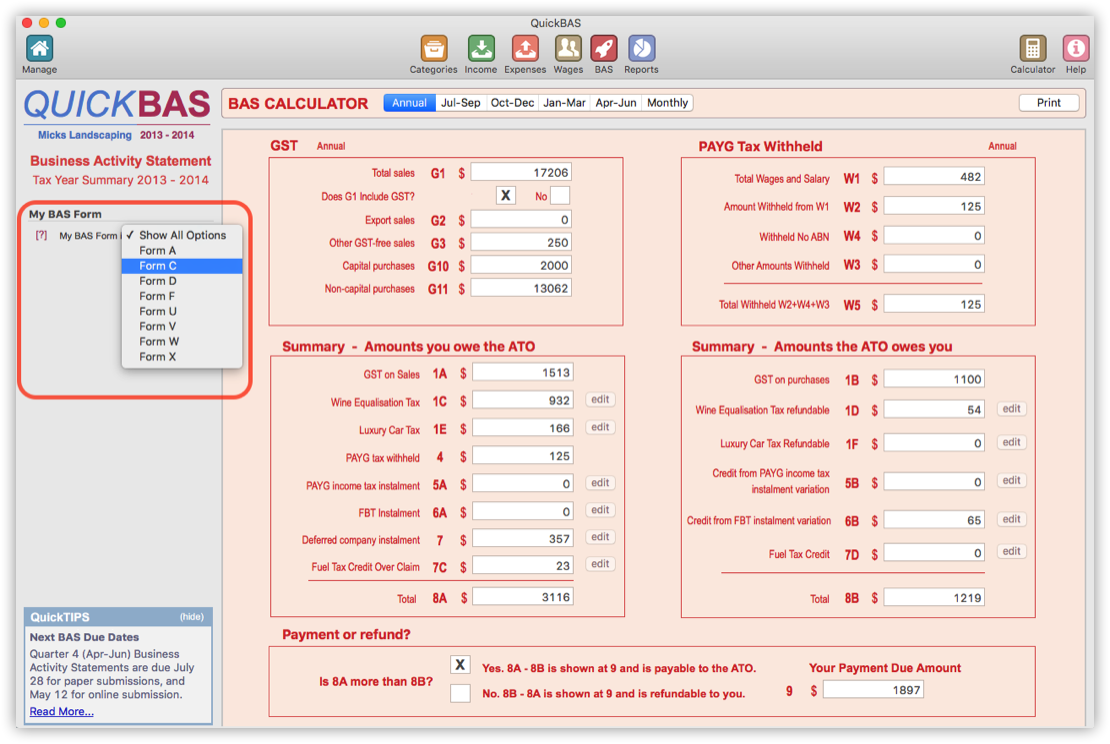

Set Your BAS Form (optional)

- By default, QuickBAS shows all BAS options

- Your paper or online form may not have all of these options

- You can choose to hide the fields that are not relevant to your BAS

- You can find your form type in the top left corner of your paper BAS form

- Note that choosing a BAS form does not alter your values, it is just for convenience

- If you choose a form that hides fields that have entered values, you will get a warning notice

- If in doubt, simply click on the “Show All Options”

- By default, QuickBAS shows all BAS options

- Your paper or online form may not have all of these options

- You can choose to hide the fields that are not relevant to your BAS

- You can find your form type in the top left corner of your paper BAS form

- Note that choosing a BAS form does not alter your values, it is just for convenience

- If you choose a form that hides fields that have entered values, you will get a warning notice

- If in doubt, simply click on the “Show All Options”

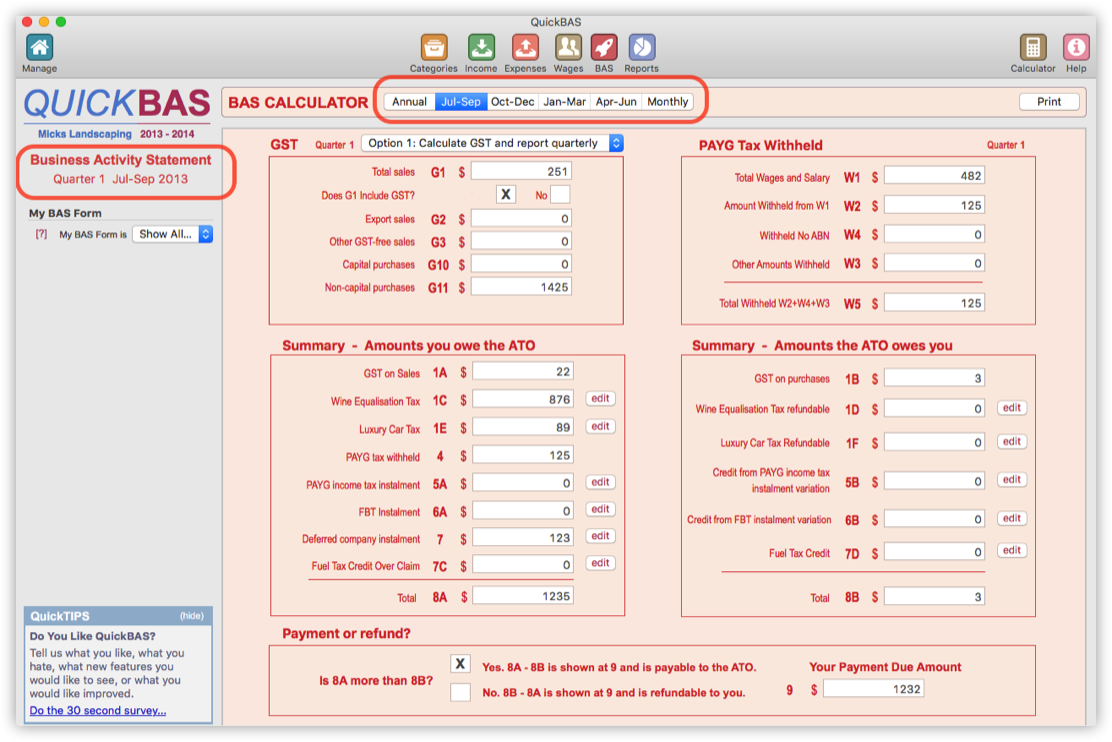

Set Your BAS Period

- When you first open a Worksheet, the BAS Sheet shows an annual summary

- Most small businesses report quarterly

- You set which quarter you wish to report in the options above the BAS sheet

- Your choice is also shown under the QuickBAS logo

- When you first open a Worksheet, the BAS Sheet shows an annual summary

- Most small businesses report quarterly

- You set which quarter you wish to report in the options above the BAS sheet

- Your choice is also shown under the QuickBAS logo

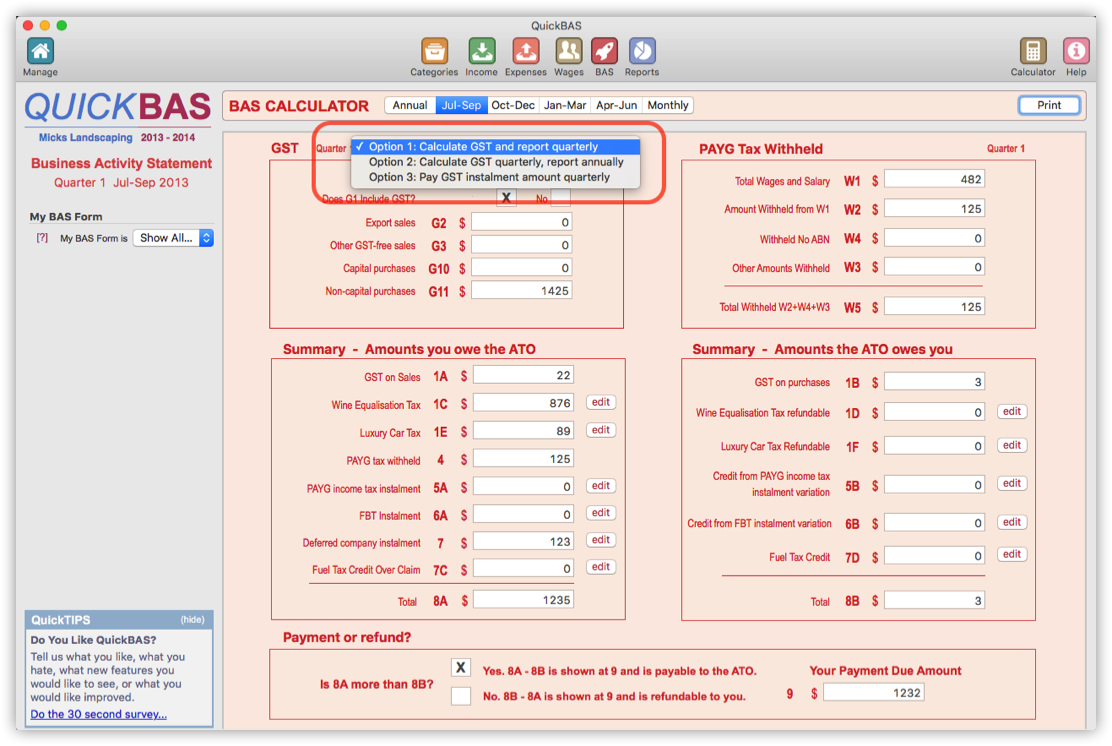

Set Your BAS Reporting Options

- Most businesses use option 1: Calculate GST and Report quarterly

- You can also choose other options:

- Option 2: Calculate GST Quarterly and Report Annually

- Option 3: Pay GST Instalment amount

- Refer to the ATO website or accountant to decide the best option for your business

- If you change your reporting options, click “Set” or “Save” to save it for that quarter

- Most businesses use option 1: Calculate GST and Report quarterly

- You can also choose other options:

- Option 2: Calculate GST Quarterly and Report Annually

- Option 3: Pay GST Instalment amount

- Refer to the ATO website or accountant to decide the best option for your business

- If you change your reporting options, click “Set” or “Save” to save it for that quarter

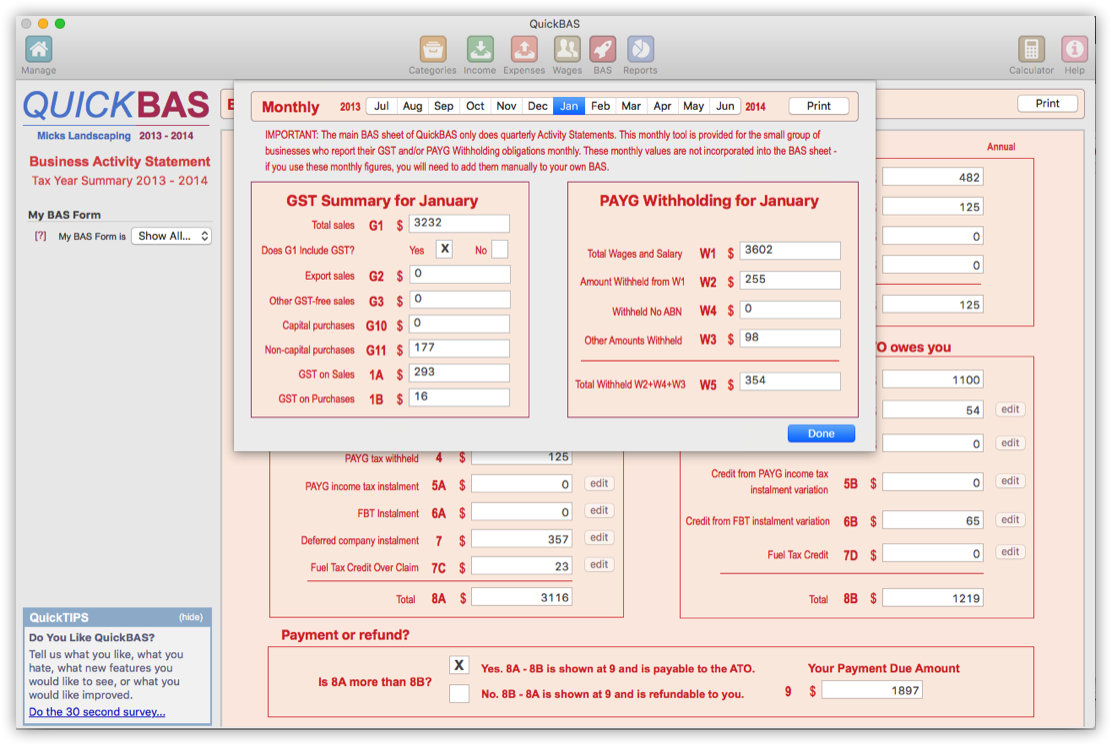

Monthly BAS Reporting

- QuickBAS is designed for the large majority of businesses that report quarterly

- Some businesses have monthly reporting requirements

- Click the Monthly tab in the period chooser, and choose the month

- The QuickBAS monthly option provides some data to assist with monthly reporting

- A monthly GST and PAYG Withholding summary is shown for each month

- However, note that QuickBAS does not support full monthly BAS reporting

- QuickBAS is designed for the large majority of businesses that report quarterly

- Some businesses have monthly reporting requirements

- Click the Monthly tab in the period chooser, and choose the month

- The QuickBAS monthly option provides some data to assist with monthly reporting

- A monthly GST and PAYG Withholding summary is shown for each month

- However, note that QuickBAS does not support full monthly BAS reporting

QuickBAS User Guide - Business Activity Statement Options