The BAS Sheet - Submitting Your Business Activity Statement

QuickBAS Does Not Submit Your BAS

- QuickBAS is a tool to help you calculate GST and other BAS requirements

- QuickBAS does not submit your BAS to the ATO

- It is your responsibility to enter data correctly, check your values, and submit your BAS

- QuickBAS is a tool to help you calculate GST and other BAS requirements

- QuickBAS does not submit your BAS to the ATO

- It is your responsibility to enter data correctly, check your values, and submit your BAS

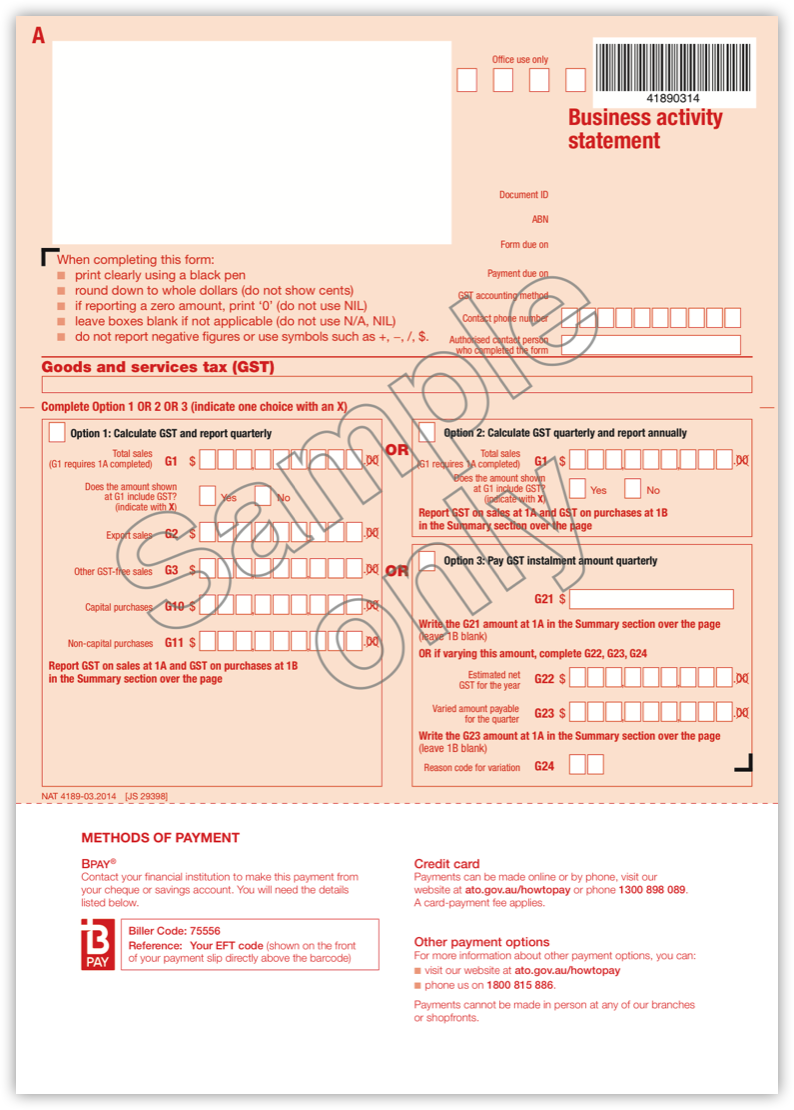

Submitting Your BAS on Paper

- Most businesses will receive a paper BAS form each quarter

- The BAS form may include your PAYG Income Tax Instalment amount

- The QuickBAS BAS sheet will not look exactly like the paper form

- However, each field is labeled and corresponds to a field on your paper form

- For example, G1 is Total Sales on both QuickBAS and the paper BAS form

- You must transfer the values from QuickBAS to the same fields on the paper form

- Ensure you have the correct Quarter showing on your BAS Sheet

- Then post your form to the ATO

- Most businesses will receive a paper BAS form each quarter

- The BAS form may include your PAYG Income Tax Instalment amount

- The QuickBAS BAS sheet will not look exactly like the paper form

- However, each field is labeled and corresponds to a field on your paper form

- For example, G1 is Total Sales on both QuickBAS and the paper BAS form

- You must transfer the values from QuickBAS to the same fields on the paper form

- Ensure you have the correct Quarter showing on your BAS Sheet

- Then post your form to the ATO

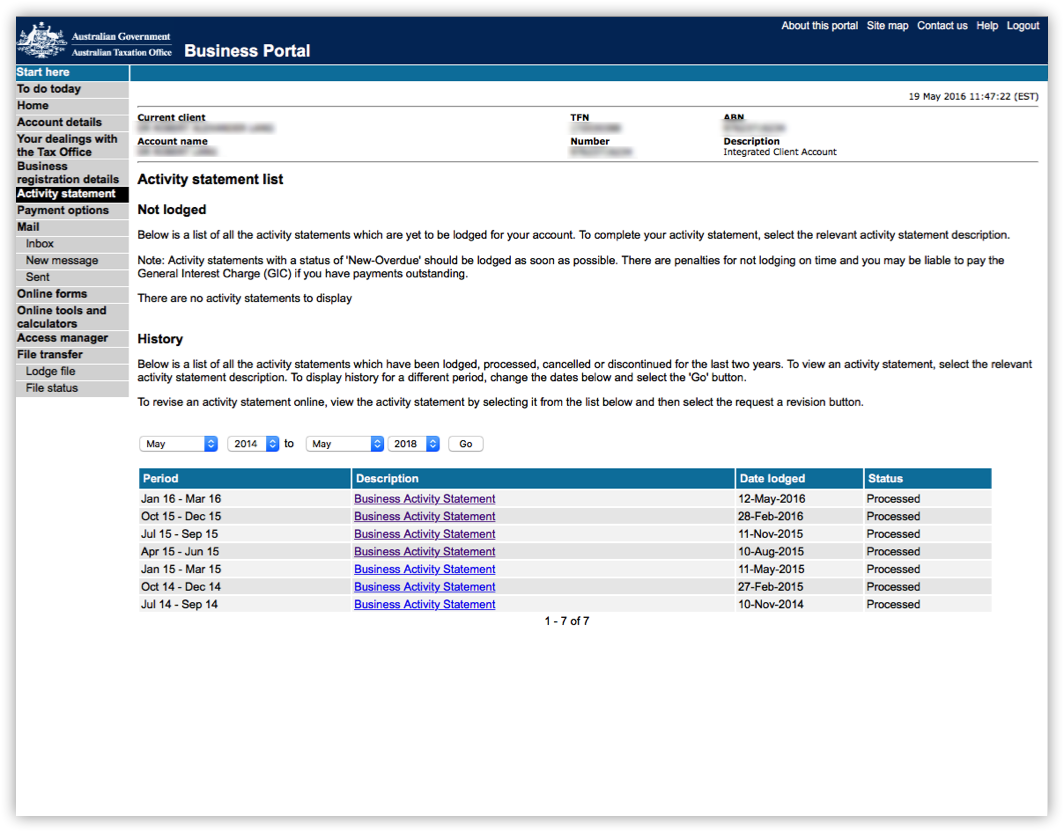

Submitting Your BAS Online

- Many businesses choose to submit their BAS online

- Advantages: it is quick, does not rely on postage, you get an extra 2 weeks to pay

- You also have access to all previously submitted Activity Statements

- QuickBAS does not directly submit your BAS online

- This is done via the ATO’s website and business portal

- Setting up an online account requires downloading Auskey software

- Online BAS submission works with PC and Mac

- Please refer to the ATO website for instructions on setting up your business portal

- Once it is set up, it is simply a matter of logging in each quarter to access your BAS

- Like paper reporting, you must transfer the QuickBAS values to the corresponding online version

- Many businesses choose to submit their BAS online

- Advantages: it is quick, does not rely on postage, you get an extra 2 weeks to pay

- You also have access to all previously submitted Activity Statements

- QuickBAS does not directly submit your BAS online

- This is done via the ATO’s website and business portal

- Setting up an online account requires downloading Auskey software

- Online BAS submission works with PC and Mac

- Please refer to the ATO website for instructions on setting up your business portal

- Once it is set up, it is simply a matter of logging in each quarter to access your BAS

- Like paper reporting, you must transfer the QuickBAS values to the corresponding online version

QuickBAS User Guide - How to Submit Your BAS